Tinashe Makichi Business Reporter

Tinashe Makichi Business Reporter

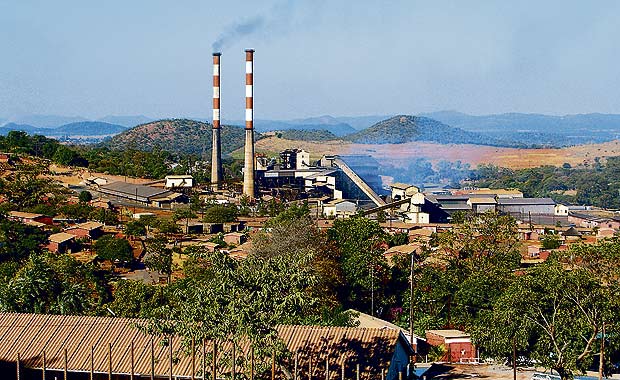

Bindura Nickel Corporation will save about $9 million annually in transport and logistical costs when the company re-opens its smelting plant next year, a company official said.

Currently BNC is using 12 trucks per day to transport nickel concentrate to South Africa and the re- opening of the smelter is set to reduce the number to one truck per day. In an interview on the sidelines of the company’s analyst briefing yesterday, BNC technical director Mr Thomas Mashungupa said the revival of the smelter is going to reduce the company’s transport and logistics costs.

“The smelter is anticipated to be in operation in the first half of 2015 and the company hopes to save about $9 million since beneficiation would be done locally.

“This move is also set to enhance the company’s capacity to eliminate penalties on deleterious minerals found within nickel concentrate hence boosting revenue,” said Mr Mashungupa. Mr Mashungupa said the smelter re-opening project has been approved by the shareholders with $26.5 million financing required. He said part of the funding will come from the cash generated by the company while the remainder will be raised through debt.

BNC managing director Mr Batirai Manhando added that the company continues to see unprecedented turnaround in its financial performance. BNC is also witnessing a significant improvement on its cash generating capacity following the introduction of a mining plan.

The company’s revenue increased to $65 million for the year ended March 2014 from $1 million recorded during the same period last year due to an increase of nickel sales.

Operating profit increased 30 percent to $17 million from $13 million recorded in the previous period.

Mr Manhando said during the period of care and maintenance, the company incurred losses and as a consequence, built up significance accumulated tax loss.

He said in terms of IAS 12, the company has recognised these losses as an asset, resulting in a credit to the income statement of $7,3 million.

“Prestart costs amounting to $3,4 million were capitalised in the first months of the year and an amount of $0,7 million was written back to profit following an independent review of the rehabilitation provision,” said Mr Manhando.

As a consequence to the ramping up of production, a cash requirement for working capital was $10 million, of which $5 million was used to fund current operations, notably inventories.

Total equity for the company rose to $27 million for the period from $3 million recorded in the comparative period last year mainly because profitability of the company has continued to see a significant improvement in equity. Total equities and liabilities for the company increased to $74 million for the period under review from $58 million in the prior period.

Mr Manhando said they are expecting a robust nickel price movement, a situation that comes at a time when BNC is considering developing its Hunters Road project.